davidf/iStock Unreleased via Getty Images

There is growing consensus among Wall Street analysts that the relentless bull market rally in the S&P 500 Index (SP500) is simply unsustainable, and that investors face the imminent risk of a sharp reversal. Such bearish warnings offered by the financial media must have become so familiar to readers that they are beginning to sound like mere complaints rather than professional investment advice. And one can't help but wonder why the consensus has so often been caught on the wrong side of the market. Why do professional investment advisors and portfolio managers regularly misjudge market behaviour? Why are markets seemingly so unpredictable?

At Stratos Capital Partners, our team has had extensive debates and profound discussions on the subject matter over the years. In this article, we shall share some of the most interesting ideas and wisdom we have come to appreciate whenever we think about financial markets.

Exploring The Bearish Narrative And Psychology

Passive buy-and-hold investors rarely complain about unpredictable markets. This is mainly because passive equity strategies are designed to weather equity market drawdowns and focus on extracting returns over market cycles. Although asset class returns do vary significantly in the short term, they generally exhibit stable risk-adjusted returns over long investment horizons. Of course, passive buy-and-hold investors do sell stocks from time to time for various reasons. We consider rotating between individual stock positions while maintaining a relatively stable strategic allocation to equities over time as predominantly a passive investing approach.

Bearish psychology, therefore, is essentially a product of attempts to time markets. Significantly reducing equity exposure to stay in cash, or persistently underallocating to equities must mean one is expecting prices to fall and is hoping to avoid potential losses. While shorting equities is purely an attempt to profit from falling prices.

It is mainly this need to time markets that dominates market behaviour and drives price swings over short periods of time. To better understand the bearish psychology driving markets, it may be helpful to consider the current market cycle as an example.

Back in 2022, skepticism towards the equity market was mainly driven by fear that some kind of economic crisis was imminent or inevitable. Initially, the bears warned of stagflation resembling the tumultuous years of the 1970s. When the Federal Reserve (Fed) eventually tightened monetary policy and implemented a series of rate hikes, the bears added to the narrative that there was near certainty of a recession in 2023 because the yield curve had inverted. But when inflation continued to cool while the economy remained resilient, the bearish narrative turned towards expensive equity valuations and the narrow tech-driven rally as reasons to be fearful. Along the way, there were also other risks including a ballooning U.S. national debt, regional bank runs, commercial real estate bankruptcies, deglobalization, and geopolitical tensions, among many others. Today, the bearish narrative points to an economy that is doing exceptionally well as a problem for the equity market. The bearish argument is that rate cuts may be delayed and that the equity market has underestimated the scenario of a "higher-for-longer" interest rate environment.

Investors must be wondering why the bearish narrative keeps changing. And why exactly should equity markets drop when the economy is doing well while inflation continues to cool? To be fair, inflation remains stubborn and is hovering above the Fed's desired target of 2% at the time of writing. But the bearish narrative of a stagflationary crisis is mostly behind us and there is little evidence to suggest that inflation will return to its 9% peak recorded in June 2022.

This is one of the major problems with bearish psychology: bears are constantly obsessed with economic risks while underappreciating the natural momentum lifting equity markets over time. Bears also fail to recognise that equity markets have regularly outperformed despite economic uncertainties in the past. This is because mere risks do not necessarily impact equity valuations unless there is a real likelihood that those risks will materialize and impact future earnings. This explains the old Wall Street adage: "The stock market climbs a wall of worry".

Some may wonder at this point. What is wrong with worrying about risks to the economy and equity markets? Surely, being a well-informed investor should provide an advantage at market timing? Now, let us dive into several reasons why having more information about the economy does not necessarily provide an advantage for investors.

Upside Risks, Downside Risks, And Media Bias

First of all, investors should appreciate the simple fact that risks will always be part of the equation when assessing the prospects of an economy. And there will always be upside risks as well as downside risks. The implication here is that an objective analysis of the equity market should consider not just one-sided risks to the economy, but rather a well-balanced view of all possible scenarios.

Unfortunately, the financial media is often the main culprit for nurturing a biased view towards a single risk factor that could impact the equity market. This makes perfect sense for the media business. Moderate and balanced views of the economy seldom attract the attention of readers. This is also why news headlines such as "Inflation Highest In Four Decades" and "Yield Curve Inversion Flags Bear Market" tend to attract the most readers. During election years, the financial media also tends to portray the economy as being highly sensitive to political events and heavily dependent on election outcomes. The financial media rarely presents a well-balanced view of the economy with multiple possible scenarios, because such articles usually leave readers more confused and undecided about the economy. But uncertainties are almost always part and parcel of investing.

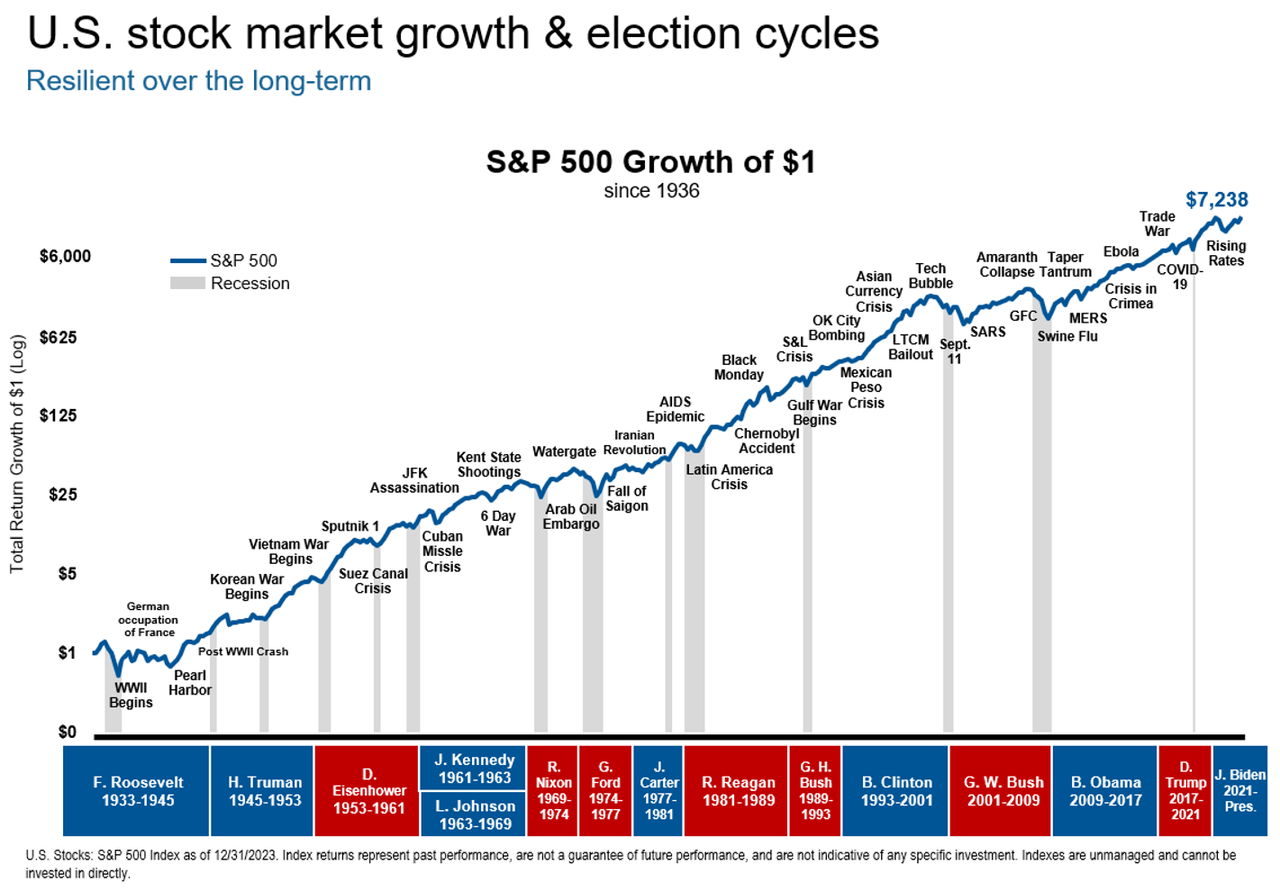

Below is a chart from Russell Investments showing how economic crises and election outcomes since 1936 have had a limited impact on the performance of long-term investors.

Russell Investments

Major bubbles and economic crises, such as the 2000 Dot-com Bubble, the 2008-2009 Global Financial Crisis, and the most recent 2020 COVID-19 pandemic, have resulted in deep and protracted drawdowns on the SPX. Some of these major drawdowns took several years to recover from trough to peak. This prospect of facing a deep drawdown is perhaps the main reason why investors constantly attempt to time markets, hoping to sell the peaks and buy the troughs.

The Odds Are Stacked Against The Bears

Many studies, however, have shown that most investors fail miserably at market timing, especially over short time frames. Below, we summarise some key takeaways from an article published by the Chartered Alternative Investment Analyst Association (CAIA).

On the asymmetric impact of successfully timing bull versus bear markets:

An interesting study published in 1986 by finance researchers Jess Chua and Richard Woodward questioned whether poor results achieved by market timing result from an inability to avoid bear markets or the tendency to miss the early part of a market recovery. Their research showed that to achieve investment success, it was more important to correctly forecast bull markets than to correctly forecast bear markets. Their study showed that from 1926 to 1983 average returns achieved by predicting just 50% of bull markets underperformed buy-and-hold strategies, even when bear markets were forecasted with perfect accuracy.

And more on the asymmetric impact of avoiding worst trading days versus missing best trading days:

The perfectly accurate market timer who avoided the 25 worst trading days would have generated an annual return of 15.27%, before fees and taxes. However, the investor who missed the best 25 days realized an annual return of only 5.74%.

In short, even successful market timing disproportionately favours the bulls over the bears.

So why do equity markets favour the bulls over the bears? This is partly due to the natural consequence of market psychology, where bull markets tend to rise gradually as optimism builds over extended periods of time, while bear markets tend to be driven by panic selling and a rush for the exit. Investors typically are in no rush to participate in a bullish story but are likely to dump equities at the first sign of a crisis. If an investor is forced to make a blind guess if a random year is bullish or bearish, there is around a 70% chance that it will be a bullish year.

The bearish bias in financial media reporting only adds to the temptation to time markets. This coupled with the fact that most investors are risk-averse, makes a potent trap for the bears.

At this point, we should perhaps provide a word of caution to bullish investors: the same bias applies to excess optimism over technological breakthroughs, speculative fads, and economic booms. Although much less frequently, the financial media has occasionally promoted speculative investment opportunities that seemingly provide "low-risk-high-return" opportunities. Recall how Tesla's (TSLA) valuations at some point implied that the company was worth as much as the combined market cap of the nine largest automaker companies. Similarly, few investors are questioning the promise of artificial intelligence and valuations of technology companies such as Nvidia (NVDA), which trades at a ridiculous trailing P/E multiple of around 70x at the time of writing.

Passive Versus Active

If biased financial media reporting, investor risk-aversion, and the asymmetric risk-reward of market timing are not enough to undermine the bears, they are also outnumbered by passive investments. According to an article published by Nasdaq, although as much as 70% of the U.S. equity market is ultimately owned by individual investors, retail trading only makes up around 20% of trading activity.

Nasdaq

Meanwhile, high net-worth investors and institutional investors (pension funds, endowment funds, and sovereign wealth funds) are generally passive investors, but they require more trading to work larger orders.

Nasdaq

An overwhelming share of passive investors in the market means that billions of dividends paid each year are reinvested back into the equity market, representing a wall of liquidity that is ready to scoop up shares whenever the market dips.

This is one of the reasons why we think bull markets are often much more resilient to negative economic news. Because long-term investors tend to look beyond short-term risks as long as the longer-term outlook of the economy remains fundamentally sound, these investors will choose to buy more shares in the face of short-term risks. This is why equity markets tend to be forward-looking and rebound well before there is clear evidence that an economic crisis is over.

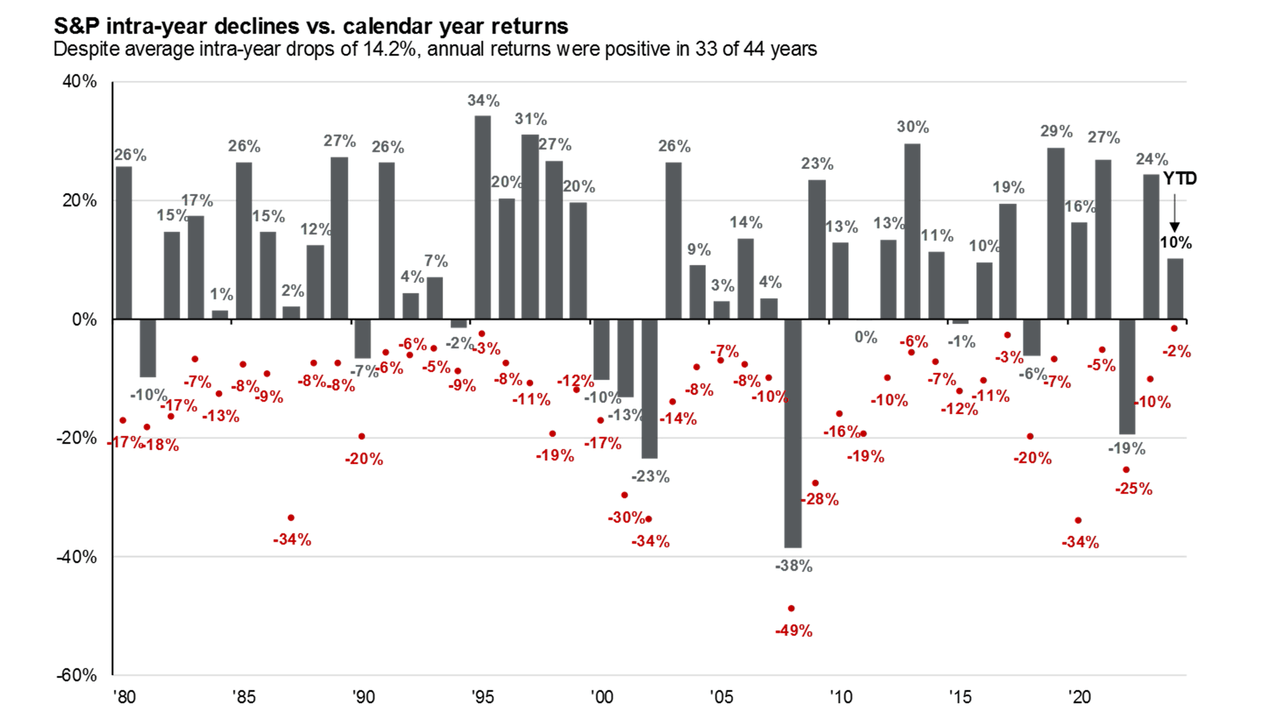

Therefore, bear markets are few and far between. Bear markets typically occur only when there is a real threat of an economic crisis at play. Even then, modern-day fiscal and monetary policies are institutionalized to respond and stimulate the economy when needed. This is why we think recent bear markets in 2020 and 2022 were relatively mild and short by historical standards (-34% and -25% intra-year declines, respectively).

J.P.Morgan

Due to the nature of bear markets, which tend to occur infrequently and last only for a short period of time, being a profitable bear requires precise market timing skills. Or a good dose of dumb luck.

The Equity Market's Natural Upward Drift

We mentioned earlier that bears tend to underappreciate the natural momentum lifting equity markets over time. Passive money flowing into retirement and pension funds each month partly contributes to this upward drift in equity markets over time. However, there are much larger long-term macroeconomic forces at play that underpin this upward momentum in equity prices.

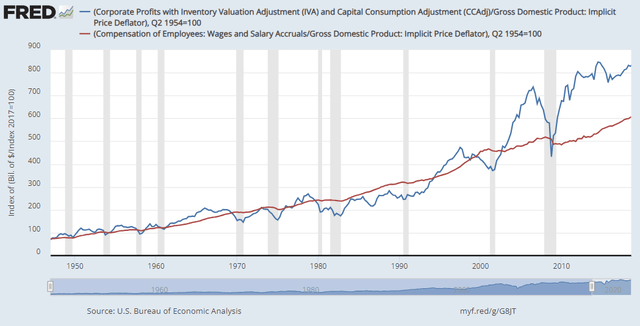

Firstly, economies expand over time due to population growth, labour productivity growth, and technological advancements (see Solow-Swan Model). Because capitalist economies favour the owners of capital, corporations extract the lion's share of this economic growth over time. Corporate earnings have also risen much faster than wages, which explains why investing for retirement plays a much more important role than relying solely on savings from a paycheck.

FRED

Secondly, equity prices are measured in nominal terms, just like the price of any goods or services we pay for. This means it is quite normal to expect equity prices to rise in tandem with inflation over time, which is a broad and general rise in the prices of goods and services.

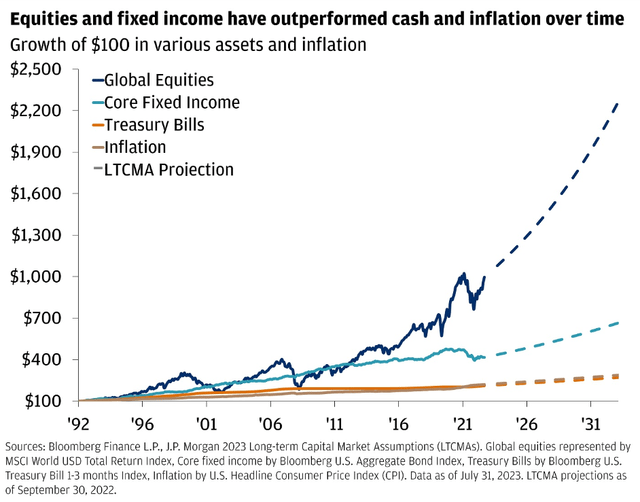

J.P.Morgan

In fact, equities have consistently outperformed inflation over time. Unless one is confident in predicting an economic depression or a deflationary environment, being a bear means swimming against the tide of economic growth and inflation.

The Cost Of Sitting On The Sidelines & Compound Returns

Perhaps one of the least appreciated problems of being a bear is the opportunity cost of sitting on the sidelines. Quite often, amateur investors oversimplify the problem of measuring investment performance by separating success and failure based solely on whether an equity portfolio has made profits or suffered losses.

Instead, the proper way of measuring performance is to compare the actual return on a portfolio to the return of its original strategic allocation. For example, if an investor has decided at the inception of the portfolio to fully invest in U.S. large-cap equities (100% equity allocation) then the S&P 500 Index (SPX) would be an appropriate benchmark for comparing performance. For investors with a partial allocation to large-cap equities, the SPX should then be used to benchmark solely the equity component of the portfolio.

Accordingly, if an investor decides to stray from the original strategic allocation of a portfolio and ends up missing the entire bull market or just a portion of it, that investor has in reality suffered an opportunity cost. The investor is underperforming even though he is still earning interest on cash. Because this opportunity cost of missing out is not clearly visible on brokerage account statements, investors often overlook opportunity costs.

Furthermore, because the thought of suffering a potential loss by staying invested through a potential bear market is conceptually much easier to understand compared to opportunity costs, amateur investors tend to be more susceptible to the fear of losses. This aversion to risk makes "avoiding losses" a constant temptation to time equity markets while making "sitting in cash" seem rather harmless.

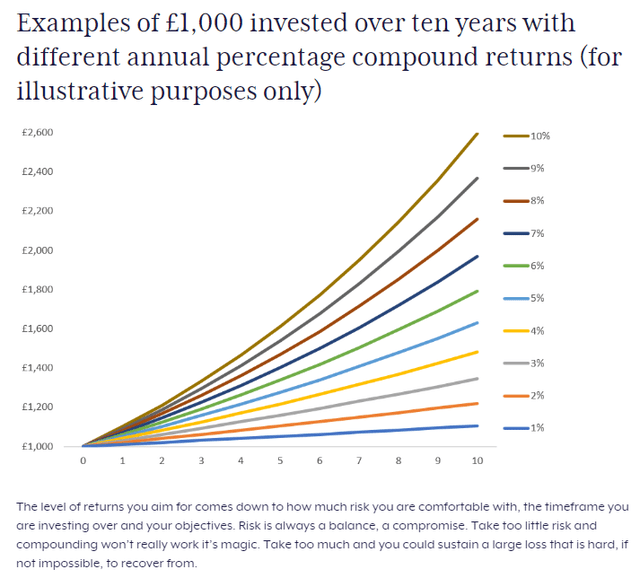

Below is a chart from Charles Stanley, providing examples comparing the impact of compound returns at different rates of return over 10 years.

Charles Stanley

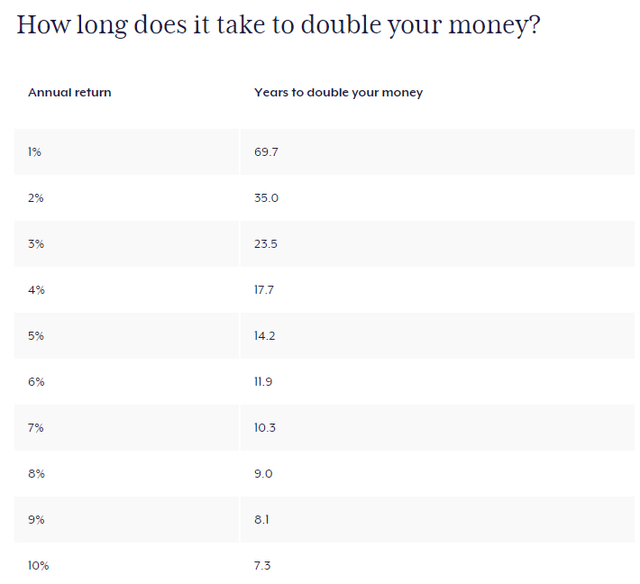

And how long it takes for different rates of return to double an initial investment.

Charles Stanley

As we have demonstrated, it clearly doesn't pay to be bearish given the odds are heavily stacked against the bears. Perma-bears suffer the most. Because being bearish over an extended period of time while being obsessed with the risks of recessions, stagflation, banking crises, property market bubbles, and stretched equity valuation, means potentially missing out on the compounding effect of equity returns over time.

So the next time one feels the urge to sell equities and time markets, it might be wise to reconsider.